Section 138A of the Income Tax Act 1967 provides that the Director General is empowered. Here is the list of Company Tax Deduction in year 2021.

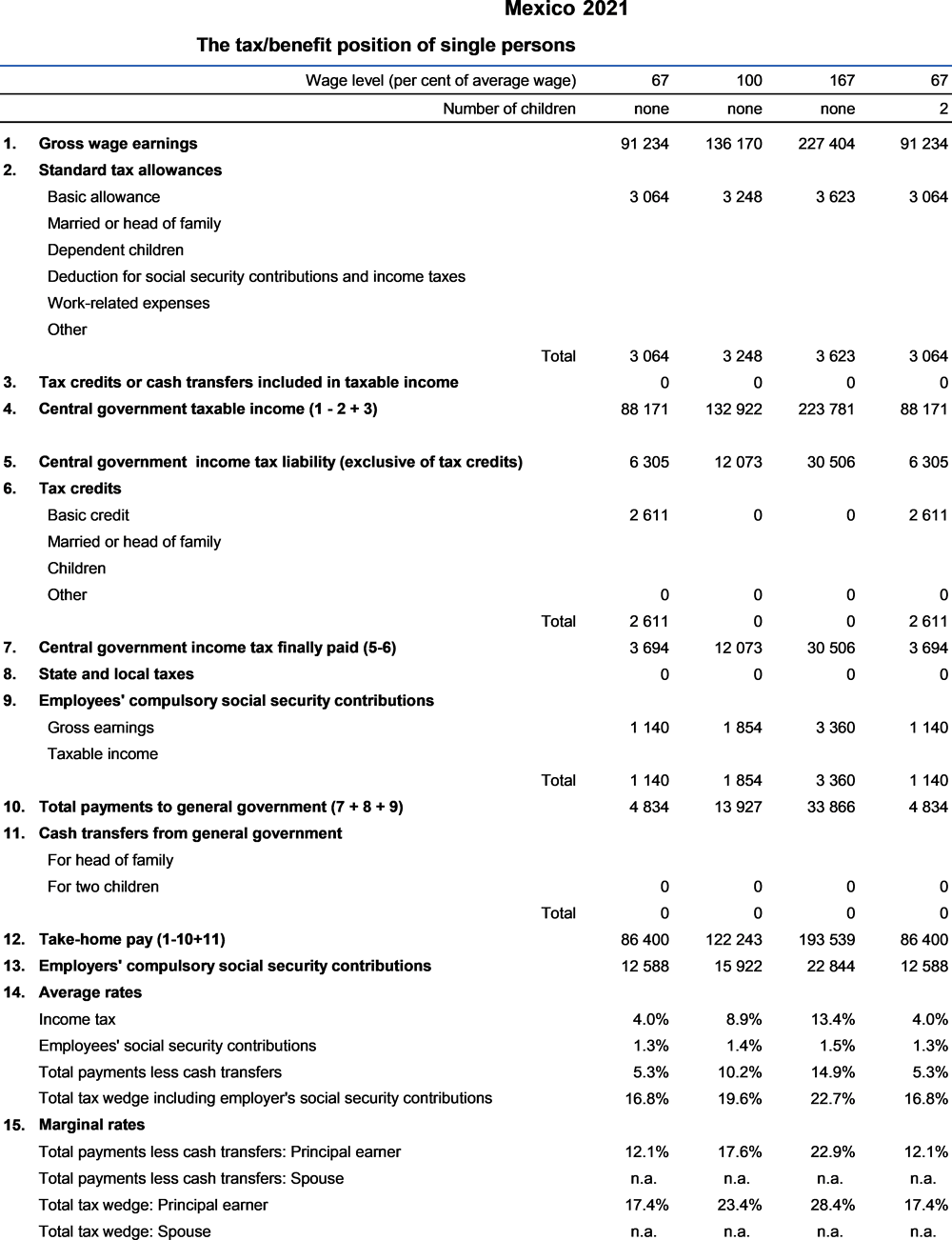

Mexico Taxing Wages 2022 Impact Of Covid 19 On The Tax Wedge In Oecd Countries Oecd Ilibrary

In general medical fee for the employee is tax-deductible under S 33 of the Income Tax Act 1967.

. Is directors medical expense tax-deductible in Malaysia. For small and medium enterprise SME the first RM600000 Chargeable Income will be tax at 17 and the Chargeable Income above RM600000 will be tax at 24. After all the limited company is the employer and the director is the employee.

Does the mention of Taxation Stress You. KTP Company PLT AF1308LLP0002159-LCA In general medical fee on employee is tax deductible under S 33 of the Income Tax Act 1967 AskKtpTax AskThkAcc. Purchase of breastfeeding equipment once every two years for women taxpayers only.

Purchase of breastfeeding equipment for own use for a child aged 2 years and below Deduction allowed once in every 2 years of assessment 1000 Restricted 13. Declaration of bonus or director fee 2021 although payment made in 2022 are eligible for tax deduction. Currently expenses incurred on secretarial and tax filing fees are given a tax deduction of up to RM5000 and RM10000 respectively for each year of assessment YA under the Income Tax Deduction for Expenses in relation to Secretarial Fee and Tax Filing Fee Rules 2014 PU.

And deduct and remit the Monthly Tax Deduction PCB to. AskKtpTax AskThkAcc 260422 2. The SME company means company incorporated in Malaysia with a paid up capital of ordinary share of not more than RM25 million.

When we talk about allowances the top-management side may consider it as an additional payout on top of the regular salary wages. Directors Remuneration and Tax Planning- Evidence from Malaysia. Under section 131 b Income Tax 1967 medical and dental benefits are exempted from income tax for employees.

Read a September 2021 report prepared by the. Why is Tax Planning so Important. THK Management Advisory Sdn Bhd - Medical Fee on director is a tax exempted BIK.

Updated guidance addresses the taxation of professional services and specifically amounts paid to directors and office holders. 3536 total views 6 views today. A complete medical examination.

Additional deduction of MYR 1000 for YA 2020 to. However depending on the type of allowance some LHDN tax deductions are applicable and you can meet both top-management and employees expectations. For tax relief purposes refers to a thorough examination as defined by the MMC.

In this article Seekers will share. Statutory audit fees expenditure PUA 129 - Income Tax Deduction For Audit Expenditure Rules 2006 54 Defending title to property. Monthly Tax Deduction MTD 31 11.

Quickly jot down and share to your friends. TAX TREATMENT OF LEGAL AND. For this medical expense you can claim up to RM1000 and it is applicable for any complete medical examinations done on you your spouse or your children.

Resident companies are taxed at the rate of 24. LEGAL and professional expenses are deductible under the Income Tax Act 1967 ITA when they are incurred in the maintenance of trade rights or. What you can read next.

By Thursday 12 January 2017 Published in Tax Planning. Deduction Claim By Employers 31 12. KTP Company PLT AF1308LLP0002159-LCA Can directors medical fee tax deductible in Sdn Bhd.

Employer Mar 15 2021. - Feb 19 2021 Johor Bahru JB Malaysia Taman Molek Service THK Management Advisory - Our accounting firm specializes in company secretarial practice HR payroll services outsourced bookkeeping and accounting services. Non-deductible legal and professional expenses 3 6.

A Malaysian company can claim a deduction for royalties management service fees and interest charges paid to foreign affiliates provided that these are made at arms length and the relevant WHTs where applicable have been deducted and remitted to the Malaysian tax authorities. Declare Bonus or Director Fee in Accrual Basis. A notable update addresses the service tax treatment of directors fees or fees paid to office holdersincluding allowances and benefits-in-kind provided to directors.

Changes in year 2020 onwards. - Feb 19 2021 Johor Bahru JB Malaysia Taman Molek Service THK Management Advisory - Our accounting firm specializes in company secretarial practice HR payroll services outsourced bookkeeping and accounting services. 19 NOVEMBER 2019.

In this article the author urges the tax authority to review the deductions available in Public Ruling 62006. Updates and Amendments 32. INLAND REVENUE BOARD OF MALAYSIA Translation from the original Bahasa Malaysia text DATE OF PUBLICATION.

In Budget 2020 to provide additional flexibility to. CO A SDN BHD must include this RM100000 director fee in the Form EA 2019 of VICTOR CHOONG. Director medical fees tax deductible malaysia 1.

Expenses incurred on secretarial and tax filing fees give a tax deduction of up to RM5000 and RM10000 respectively for each year of assessment YA. As a forensic accountant I acted as expert witnes on a couple of cases for insurance companies where the director sued the company for personal injuries - even though they were one. 112019 - Benefits In Kinds.

Payment for child care fees to a registered child care centre kindergarten for a child aged 6 years and below. And the final medical expense that you can claim. 21 Government grant or subsidy Grant or subsidy received from the Federal or State Government are exempted from income tax.

September 13 2021 Post a Comment. Directors Remuneration and Tax Planning- Evidence from Malaysia. Secretarial and tax filing fees being combined such that a total deduction of up to RM15000 per YA be allowed for both expenses from YA 2020 onwards.

TARIKH KEMASKINI 06062021 03-8911 1000 Hasil Care Line 03-8751 1000 Hasil Recovery Call Centre LhdnTube LHDNMofficial LHDNM LHDNM wwwhasilgovmy. THK Management Advisory Sdn Bhd - Medical Fee on director is a tax exempted BIK. Directors fees income received as a non-Malaysian citizen director of a Labuan entity are exempted from income tax until YA 2025.

Medical benefit child care benefit transportation fee for interstate travel. Payments to foreign affiliates. Fees paid to childcare centre and kindergarten for child ren below six years old.

Effective date 5. Director Medical Fees Tax Deductible Malaysia - 3. Malaysia offers a limited tax relief of rm 3000 for those making alimony payments towards their husband or wife.

Director General of Inland Revenue Malaysia.

Taxes From A To Z 2016 K Is For Key Employee

What Is Difference Between Nri And Nre Account Nri Saving And Investment Tips Savings And Investment Accounting Investment Tips

We Are Hiring Operations Management Recruitment Agencies Job Hunting

Making Machine 30000pcs In Stock Medical Gown Protective Uniforms Making Machine Making Glass Enigma Machine

6 End Of Year Tax Planning Tips For 2021

Can You Write Off Home Offices Ppe Due To Covid 19 Abc10 Com

What Is Difference Between Nri And Nre Account Nri Saving And Investment Tips Savings And Investment Accounting Investment Tips

Are Gifts To Customers And Business Associates Deductible Expenses

Embassy Approved Translation In Malaysia Business Advisor Accounting Services Accounting Software

What Happened To The Expected Year End Estate Tax Changes

Five Common Questions To Ask Yourself About Tax Deductible Expenses

:max_bytes(150000):strip_icc()/thinkstockphotos-144229773-5bfc2b3f46e0fb0083c06edd.jpg)

What Are Some Ways To Minimize Tax Liability

Director Medical Fees Tax Deductible Malaysia

Is Life Insurance Taxable Forbes Advisor

Tax Incentives A Guide To Saving Money For U S Small Businesses

5 Difference Between Elss Vs Ppf Vs Nsc Vs Tax Saving Fixed Deposit Nri Saving And Investment Tips Savings And Investment Income Tax Tax Free Savings

Tax Deduction For Legal Fees Is Legal Fees Tax Deductible For Business

:max_bytes(150000):strip_icc()/ScreenShot2021-05-17at12.36.12PM-22c6287a600548be8be11533f7eed51b.png)